Don't Wait! Rates Are Falling

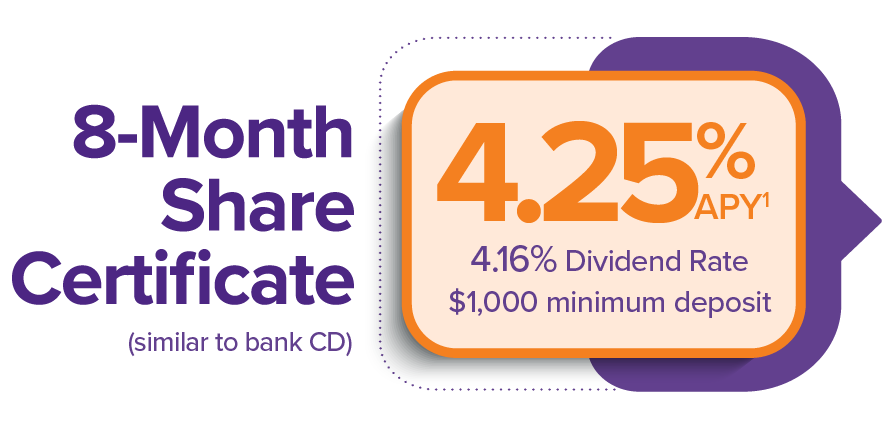

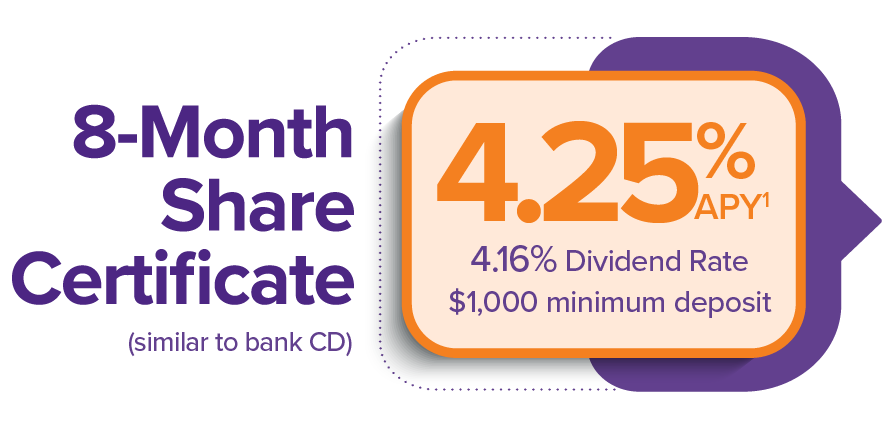

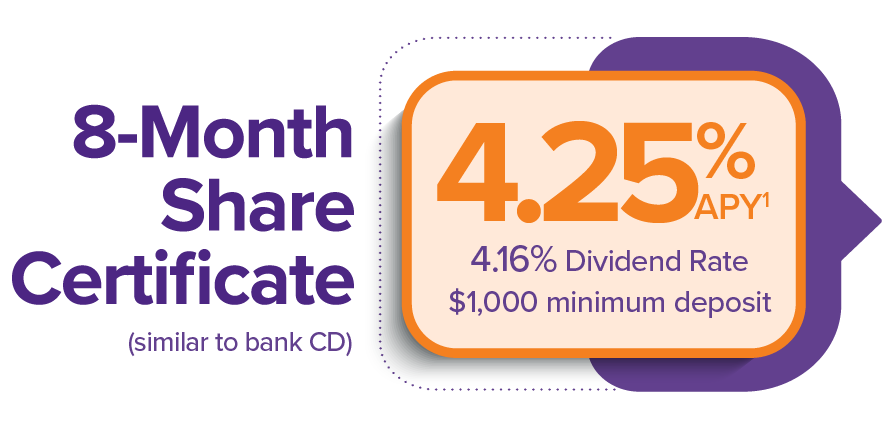

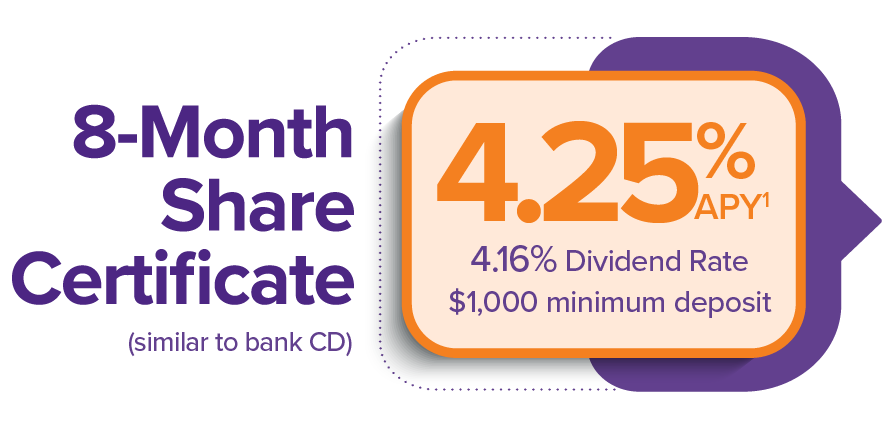

Earn higher returns with our 8-Month Special Share Certificate, featuring our highest rate

Don't wait to take advantage of our rates before they start to come down. Rates are lowering across the industry, but you can still lock in our highest rate for the best returns on your savings. Use your savings without spending your savings, by letting them accumulate dividends in our short-term special certificates. Before you know it, your earnings will be ready to collect.

Call us at (888) 354-OCCU (6228), apply online, or visit a branch to open your certificate.

Certificate's high-rate, short-term combo!

Special Term Share Certificate Rates

|

Term |

Minimum Deposit |

Dividend Rate |

APY¹ |

|---|---|---|---|

|

8-Month |

$1,000 |

4.16% |

4.25% |

|

9-Month |

$1,000 |

3.68% |

3.75% |

|

14-Month |

$1,000 |

3.54% |

3.60% |

Special Term Share Certificate Rates

|

Term |

Minimum Deposit |

Dividend Rate |

APY¹ |

|---|---|---|---|

|

8-Month |

$1,000 |

4.16% |

4.25% |

|

9-Month |

$1,000 |

3.68% |

3.75% |

|

14-Month |

$1,000 |

3.54% |

3.60% |

Enjoy our best rate with just $1,000 minimum deposit.

When you deposit funds into a Share Certificate (similar to a Certificate of Deposit or CD), you’re agreeing to leave it there, untouched for a set period of time while it earns dividends. You’ll lock in a higher return rate than a Regular Savings or Money Market account while it’s there—even if rates go down, you’ll still be earning the high rate you locked in. Learn more about share certificates here.

It depends on the term you choose and the amount you deposit. The larger the deposit, and the longer the term, the more dividends you will earn. Check our current rates or see how much you could earn with our Share Certificate calculator:

¹Rates, Annual Percentage Yield (APY), and terms are accurate as of January 1, 2025 and are subject to change at any time. Fees may reduce earnings on the account. APY is based on the assumption that certificate funds (including dividends) will remain in the account until maturity. There is a penalty for early withdrawal of certificate funds. Minimum balance to open is $1,000. The Special Term Certificates are a promotional product and may change or end without notice. Special Term Certificates will automatically renew at the nearest lower standard term (at the then applicable offered rate), unless you instruct us otherwise (at the then applicable offered rate). The 8-Month Special Term Certificates will automatically renew into the 6-Month Term.

Membership in Orange County's Credit Union is available to anyone who lives or works in Orange, Los Angeles, Riverside, or San Bernardino Counties. You may also qualify if your immediate family member banks with us. Ask us for details. Membership fee is $5.

If you have any questions or require current information on your account, please call the Credit Union at (888) 354-OCCU (6228), or stop into any of our branches.

IRA and Business Accounts cannot be opened online. Please visit a local branch to set one up.