Need help? We'll create a personalized Total Cost Analysis just for you.

Refinance Your Home Loan

Today’s Mortgage Rates

| 30-Yr Fixed | 15-Yr Fixed | 10/1 Adj | 7/1 Adj | 5/1 Adj | |

|---|---|---|---|---|---|

| Rate | 6.625% | 5.875% | 6.625% | 6.500% | 6.125% |

| APR | 6.761% | 6.070% | 6.989% | 6.978% | 6.809% |

| Points | 0.875 | 0.750 | 0.625 | 1.000 | 0.625 |

| Payment | $3,201.55 | $4,185.59 | $3,201.55 | $3,160.34 | $3,038.05 |

| Rate | APR | Points | Payment | |

|---|---|---|---|---|

| 30-Yr Fixed | 6.625% | 6.761% | 0.875 | $3,201.55 |

| 15-Yr Fixed | 5.875% | 6.070% | 0.750 | $4,185.59 |

| 10/1 Adj | 6.625% | 6.989% | 0.625 | $3,201.55 |

| 7/1 Adj | 6.500% | 6.978% | 1.000 | $3,160.34 |

| 5/1 Adj | 6.125% | 6.809% | 0.625 | $3,038.05 |

What Type of Home Loan is Right for You?

How It Works

Apply online and get an instant decision, or apply over the phone.

Check on your loan, securely e-sign, and receive documents online.

We work hard to close our loans faster than the national average.**

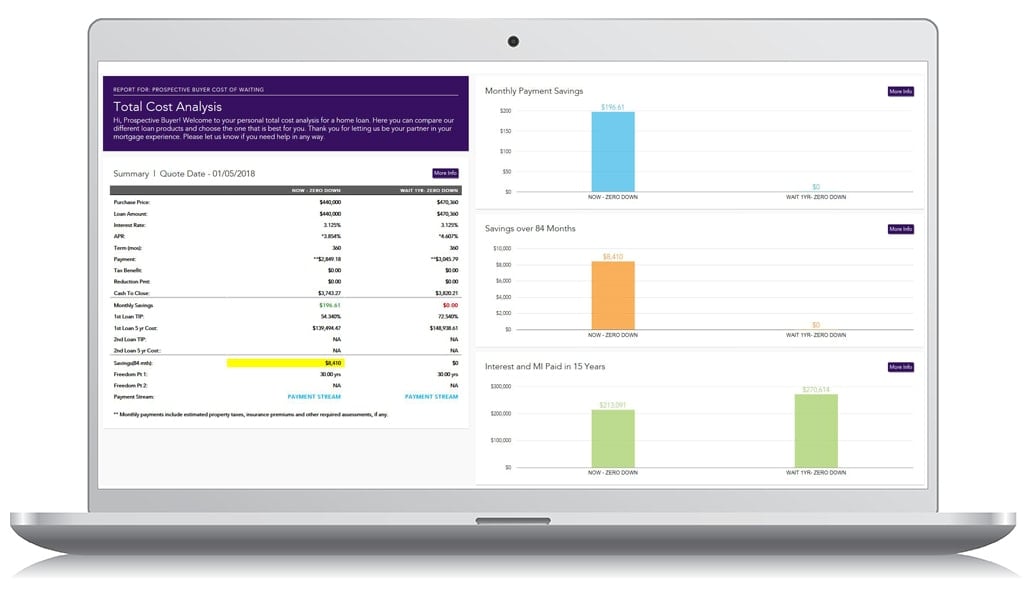

Discover Your Options with a Total Cost Analysis

Gain clarity on all of your loan options with our complimentary Total Cost Analysis service. It’s personalized to your unique situation, and offers a side-by-side comparison of your costs, savings, and options.

Simplifying the Home Financing Experience

We know what goes into the loan process–there's a lot of paperwork and a lot of time. That's why having a trusted partner who is local, experienced, and accessible will provide the guidance and peace of mind you need to obtain the home loan that meets your needs. Our Mortgage Loan Consultants will simplify the process and work with you, from start to finish. That's our promise.

Resources

- Four Things to Look for in a Mortgage Lender (article)

- 8 Improvements that Increase Your Home's Value (article)

- Should You Pay Mortgage Points (article)

- How Much Will Waiting Cost You? (article)

- HELOC or Home Equity Loan? (article)

- Fannie Mae Loan Lookup (resource)

- Freddie Mac Loan Lookup (resource)

- Protect your Investment with Homeowners Insurance (free quote)

Calculators & Tools

- Request a Total Cost Analysis (tool)

- Compare Mortgage Terms (calculator)

- Should I Refinance My Home? (calculator)

View registered Mortgage Loan Originators

This is not an offer for an extension of credit or a commitment to lend. All applications are subject to borrower and property underwriting approval. Not all applicants will qualify. Membership in Orange County's Credit Union is a condition of loan approval. Limited to funding California properties only.

*In providing a market rate comparison, Orange County's Credit Union is using information provided by an independent third-party source and is not responsible for the accuracy of the information. The comparison is provided by Informa Research Services, a financial research service.

**In providing the days-to-close comparison, Orange County’s Credit Union is using information provided by an independent third-party source. ICE Mortgage Technology® Origination Insight Report provides monthly data and insights for a robust sampling of closed loan applications that flow through ICE Mortgage Technology Encompass® mortgage loan origination system.

Supported Browsers: While most modern browsers will allow you to use the entire Home Loans experience without any problems, we suggest the latest version of Microsoft® Edge, Firefox®, Chrome®, and Safari®.

Membership in Orange County's Credit Union is available to anyone who lives or works in Orange, Los Angeles, Riverside, or San Bernardino Counties. Don't live or work in our area? You may also qualify if your immediate family member banks with us. Ask us for details. Membership fee is $5.

Immediate Family Includes:

Spouse

Child

Sibling

Parent

Grandparent

Grandchild

Stepparent

Stepchild

Adoptive Relationships